Do You Get Nectar Points On A Sainsburys Loan? Let’s Break It Down!

Here's the deal: Sainsburys, the iconic UK supermarket chain, has a lot more to offer than just groceries. They’ve got a whole ecosystem of services, including banking and loans. But the big question on everyone’s mind is, do you get Nectar points on a Sainsburys loan? Stick around, because we’re about to spill all the tea.

If you're anything like me, you're probably wondering how you can maximize those sweet Nectar points. Whether you're shopping for groceries, fueling up your car, or even applying for a loan, the idea of earning points that can be redeemed for discounts is a no-brainer. But hold up—do loans actually count toward Nectar points? Let's dive in and find out.

This isn't just a random question; it's a legitimate concern for anyone trying to make the most out of their financial decisions. After all, why not turn your loan application into an opportunity to earn rewards? In this article, we'll break it down step by step so you can make an informed decision. Ready? Let's go!

Read also:Travelvidz Xyz Your Ultimate Travel Companion In The Digital Age

Here's a quick rundown of what we'll cover:

- Overview of Nectar Points

- Sainsburys Loan Basics

- Do You Get Nectar Points on a Sainsburys Loan?

- Benefits of Sainsburys Loans

- Loan Eligibility Requirements

- Interest Rates and Fees

- How to Redeem Nectar Points

- Sainsburys Loan vs Other Options

- Tips for Maximizing Nectar Points

- Frequently Asked Questions

Overview of Nectar Points

Before we jump into the specifics of Sainsburys loans, let's take a moment to understand what Nectar points are all about. Think of them as digital gold—you earn points for spending money with participating brands, and those points can later be redeemed for discounts at places like Sainsburys, Argos, and more.

How Do You Earn Nectar Points?

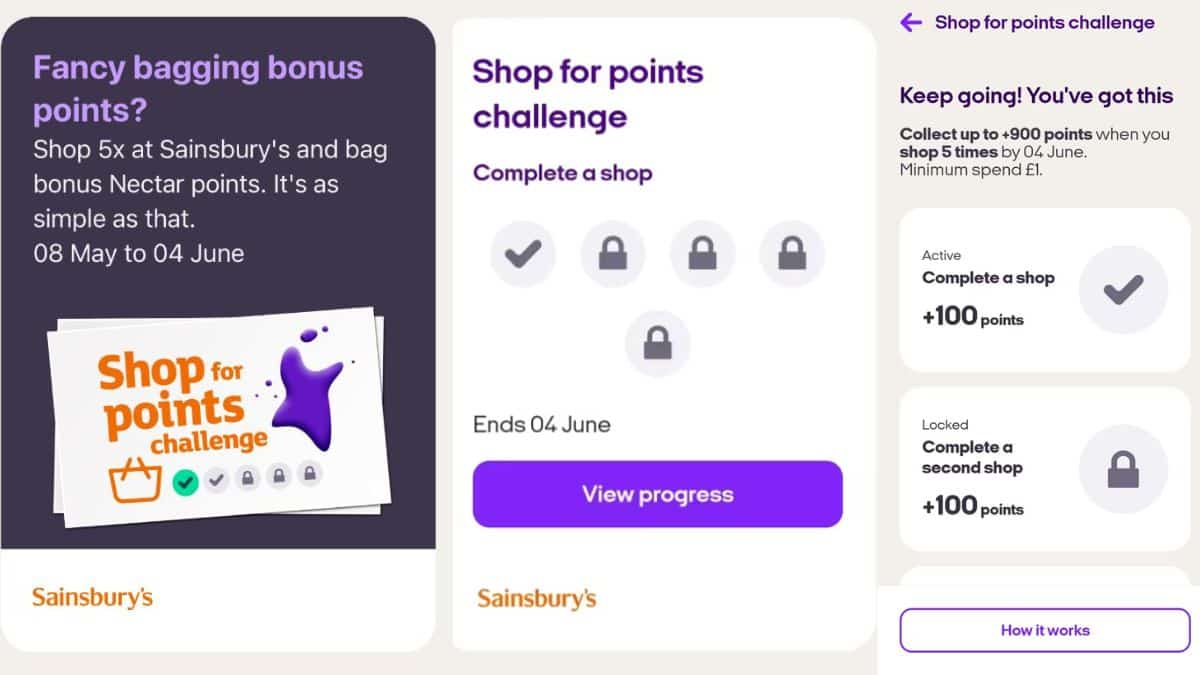

Earning Nectar points is pretty straightforward. Every time you shop at participating retailers, you can collect points based on your spending. For example, at Sainsburys, you typically earn one point for every £1 spent. But here’s the kicker—there are often bonus offers and promotions that let you rack up points even faster.

Now, when it comes to loans, things get a little tricky. Not all financial products are eligible for Nectar points, so we need to dig deeper to see if loans fall into that category.

Sainsburys Loan Basics

Sainsburys offers personal loans through their banking division, and these loans are designed to help you manage your finances more effectively. Whether you're consolidating debt, funding a home improvement project, or covering unexpected expenses, a Sainsburys loan could be a great option.

Key Features of Sainsburys Loans

Here are some of the standout features of Sainsburys loans:

Read also:Ike Barinholtz Wife The Real Story Behind The Scenes

- Competitive interest rates

- Flexible repayment terms

- No early repayment fees

- Eligibility for Nectar points (we’ll confirm this shortly)

But wait, do you really earn Nectar points when you apply for a loan? Let’s find out.

Do You Get Nectar Points on a Sainsburys Loan?

The short answer is—it depends. While Sainsburys doesn't explicitly state that all loans automatically qualify for Nectar points, there are certain promotions and offers that might allow you to earn points. For instance, if you sign up for a loan during a promotional period, you might receive bonus points as part of the deal.

How to Check for Promotions

To find out if you can earn Nectar points on a Sainsburys loan, keep an eye out for special offers. These promotions are usually advertised on the Sainsburys Bank website or through email newsletters. If you're lucky, you might stumble upon a campaign that rewards you with points just for applying.

Pro tip: Always read the fine print. Some promotions might require you to meet specific criteria, such as borrowing a certain amount or maintaining a minimum repayment schedule.

Benefits of Sainsburys Loans

Even if you don’t earn Nectar points, there are plenty of reasons to consider a Sainsburys loan. Here are some of the benefits:

- Competitive interest rates compared to other lenders

- Flexible repayment options to suit your budget

- No hidden fees or penalties for early repayment

- Convenient application process

Plus, if you’re already a loyal Sainsburys customer, taking out a loan through their bank could strengthen your relationship with the brand. And hey, who knows—you might just snag some bonus points along the way.

Loan Eligibility Requirements

Before you apply for a Sainsburys loan, it’s important to know if you qualify. Here are the basic eligibility criteria:

- You must be at least 18 years old

- You must be a UK resident

- You must have a good credit score

- You must meet the minimum income requirements

If you tick all these boxes, you’re good to go. But remember, even if you meet the eligibility criteria, there’s no guarantee you’ll be approved. Lenders consider a variety of factors when assessing loan applications, so it’s always a good idea to check your credit report beforehand.

Interest Rates and Fees

Interest rates on Sainsburys loans are competitive, but they can vary depending on your credit score and the loan amount. On average, you can expect to pay between 3.2% and 29.9% APR, depending on your individual circumstances.

Understanding APR

APR stands for Annual Percentage Rate, and it’s a measure of the total cost of borrowing. When comparing loans, always look at the APR rather than just the interest rate, as it includes any additional fees or charges.

Pro tip: If you’re looking to save money on interest, consider improving your credit score before applying for a loan. A higher credit score could mean a lower APR and more Nectar points in the long run.

How to Redeem Nectar Points

Once you’ve earned your Nectar points, it’s time to put them to good use. Here’s how you can redeem them:

- At the checkout when shopping at Sainsburys

- Online at participating retailers like Argos and eBay

- Toward travel bookings with Expedia or Virgin Holidays

- For gift cards and vouchers

Redeeming points is easy—just log in to your Nectar account and select the option you want. Keep in mind that points expire after a certain period, so it’s a good idea to use them before they disappear.

Sainsburys Loan vs Other Options

When it comes to personal loans, Sainsburys isn’t the only game in town. Other banks and lenders offer similar products, so it’s worth comparing your options. Here’s how Sainsburys stacks up against the competition:

- Competitive interest rates

- Flexible repayment terms

- No early repayment fees

- Potential for Nectar points

While other lenders might offer lower rates or better terms, Sainsburys has the added advantage of being part of a larger ecosystem. If you’re already a Nectar member, this could be a dealbreaker.

Tips for Maximizing Nectar Points

Want to make the most of your Nectar points? Here are some tips:

- Sign up for email newsletters to stay updated on promotions

- Use your Nectar card every time you shop

- Take advantage of bonus offers and double points events

- Combine points from multiple accounts for bigger rewards

Remember, every little bit counts. Even if you don’t earn points on your loan, there are plenty of other ways to rack up rewards.

Frequently Asked Questions

Q: Can I earn Nectar points on a Sainsburys credit card?

Absolute yes! Sainsburys credit cards are a great way to earn points on your everyday spending. Just be sure to pay off your balance in full each month to avoid interest charges.

Q: How long do Nectar points last?

Points typically expire after two years, so it’s a good idea to use them before they disappear. Check your account regularly to stay on top of your balance.

Q: Can I use Nectar points toward a loan repayment?

Unfortunately, no. Nectar points can’t be used to pay off loans or other financial products. However, they can still be redeemed for discounts on groceries, travel, and more.

Kesimpulan

In conclusion, whether or not you can earn Nectar points on a Sainsburys loan depends on the specific promotion or offer. While loans aren’t always eligible for points, there are plenty of other ways to maximize your rewards. From credit cards to grocery shopping, the opportunities are endless.

So, what are you waiting for? Head over to the Sainsburys Bank website and check out their latest promotions. Who knows—you might just score some bonus points while securing your dream loan. And don’t forget to share this article with your friends so they can get in on the action too!