Fintechzoom.com Loans: The Ultimate Guide To Secure Your Financial Future

So here's the deal, folks. If you're looking to dive into the world of online lending platforms, you've probably stumbled upon the name "fintechzoom.com loans." It's like the buzzword in town, right? Whether you're a small business owner trying to scale up or an individual looking for some financial breathing room, understanding fintechzoom.com loans is key to unlocking opportunities. But wait, there's more. Before you jump in with both feet, let's break it down for you in a way that's easy to digest and super actionable. You're about to get the lowdown on everything you need to know.

Now, let's not beat around the bush. Fintechzoom.com loans are designed to simplify the borrowing process for people who need quick access to funds. Think about it—traditional banks can be slow and rigid, requiring tons of paperwork and a mountain of red tape. But fintechzoom.com loans? They're all about speed, flexibility, and convenience. It's like having a personal finance assistant at your fingertips, ready to help you out when you need it most.

But hey, before you sign up for anything, you deserve to know the ins and outs. That's why we've put together this comprehensive guide. We're going to take you on a journey through the world of fintechzoom.com loans, covering everything from how they work to whether they're right for you. Buckle up, because we're about to give you the tools you need to make an informed decision that could change your financial life forever.

Read also:Uncensored Manhwa Romance Dive Into The World Of Raw Emotions

What Exactly Are Fintechzoom.com Loans?

Alright, let's start with the basics. Fintechzoom.com loans are essentially a type of online loan offered through the fintechzoom.com platform. Think of it as a digital lending service that operates outside the traditional banking system. This means you can apply for a loan from the comfort of your own home, often getting approved within hours instead of days or weeks. It's all about streamlining the process and making borrowing more accessible to the average person.

Here's the kicker: fintechzoom.com loans come in different shapes and sizes. You might find personal loans, business loans, or even short-term loans designed to help you cover unexpected expenses. The beauty of it is that the platform uses advanced algorithms to assess your creditworthiness, often allowing people with less-than-perfect credit scores to still qualify for funding. It's like a financial safety net for the modern world.

Why Are Fintechzoom.com Loans Gaining Popularity?

Let's face it—people are busy. Who has time to sit in a bank for hours waiting to talk to a loan officer? That's where fintechzoom.com loans shine. They're gaining popularity because they cater to the fast-paced lifestyle of today's borrowers. Here's why they're so appealing:

- Speed: Applications are processed quickly, often with same-day approvals.

- Convenience: Everything is done online, so you don't have to leave your house.

- Flexibility: Loan options are tailored to fit a wide range of financial needs.

- Inclusivity: Even borrowers with less-than-ideal credit scores can still qualify.

These factors make fintechzoom.com loans a go-to choice for many people who need financial assistance but don't want to jump through hoops to get it. It's like the Netflix of lending—streamlined, on-demand, and tailored to your preferences.

How Do Fintechzoom.com Loans Work?

Alright, so you're curious about the nitty-gritty of how fintechzoom.com loans actually work. Let's break it down step by step:

Step 1: Apply Online – You start by visiting the fintechzoom.com website and filling out an application form. This usually involves providing some basic information like your income, employment status, and the amount you'd like to borrow.

Read also:Masha Erome The Rising Star Redefining Creativity In The Digital Age

Step 2: Get Approved – Once you submit your application, the platform will use its algorithms to assess your creditworthiness. This process is usually quick, and you'll often receive an approval decision within minutes.

Step 3: Receive Your Funds – If approved, the funds will typically be deposited directly into your bank account within a few business days. In some cases, it can even happen on the same day.

Step 4: Repay Your Loan – Like any loan, you'll need to repay the amount borrowed plus interest. Repayment terms can vary depending on the type of loan and the amount borrowed, but they're usually structured to be manageable for the borrower.

See? It's pretty straightforward. Fintechzoom.com loans are designed to make borrowing as painless as possible, so you can focus on what matters most—your financial goals.

Types of Fintechzoom.com Loans

Now, let's talk about the different types of loans you can find on fintechzoom.com. Here's a quick rundown:

- Personal Loans: Ideal for covering personal expenses like medical bills, home repairs, or even a vacation.

- Business Loans: Perfect for small business owners looking to expand or cover operational costs.

- Short-Term Loans: Great for emergencies or unexpected expenses that need immediate attention.

- Consolidation Loans: Helps you combine multiple debts into one manageable payment.

Each type of loan comes with its own set of benefits and considerations, so it's important to choose the one that aligns with your specific needs. Think of it like picking the right tool for the job—each loan is designed to tackle a different financial challenge.

Benefits of Fintechzoom.com Loans

So, what's in it for you? Here's a breakdown of the top benefits of choosing fintechzoom.com loans:

1. Accessibility: Fintechzoom.com loans are accessible to a wide range of borrowers, including those with less-than-perfect credit scores. This inclusivity makes it easier for more people to access the funds they need.

2. Speed: As we've mentioned, the application process is lightning-fast. You can often get approved and receive your funds within hours, which is a game-changer for those in urgent need of cash.

3. Transparency: The platform is upfront about its terms and conditions, so there are no hidden fees or surprises. This transparency helps borrowers make informed decisions about their financial future.

4. Flexibility: With a variety of loan types and repayment options, fintechzoom.com loans can be tailored to fit your unique financial situation. It's all about giving you the freedom to choose what works best for you.

These benefits make fintechzoom.com loans a compelling option for anyone looking to simplify the borrowing process and take control of their finances.

Who Should Consider Fintechzoom.com Loans?

Not everyone is a good candidate for fintechzoom.com loans, but there are certain groups of people who could really benefit from them:

- Small Business Owners: If you're running a business and need capital to grow, fintechzoom.com loans can provide the funding you need without the hassle of traditional bank loans.

- Individuals with Bad Credit: Even if your credit score isn't stellar, you might still qualify for a fintechzoom.com loan. It's a great option for those who've been turned down by traditional lenders.

- People in Need of Quick Cash: Whether it's for an emergency or a planned expense, fintechzoom.com loans can provide the funds you need fast.

Ultimately, the decision to use fintechzoom.com loans depends on your specific financial situation and goals. But for many people, it's a viable solution to their borrowing needs.

Potential Drawbacks of Fintechzoom.com Loans

Of course, no financial product is without its drawbacks. Here are a few things to consider before jumping into a fintechzoom.com loan:

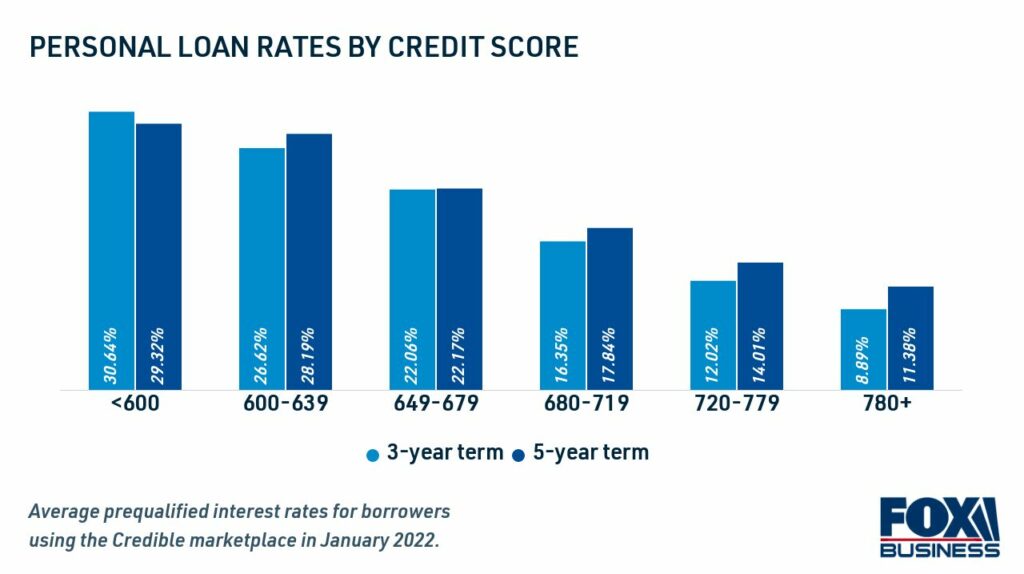

1. Interest Rates: While fintechzoom.com loans can be convenient, they often come with higher interest rates compared to traditional bank loans. This is especially true for borrowers with lower credit scores.

2. Limited Loan Amounts: Depending on your creditworthiness, you might not be able to borrow as much as you'd like. This could be a limitation for those with larger financial needs.

3. Repayment Terms: Some loans may have strict repayment terms that could be challenging for certain borrowers. It's important to carefully review the terms before committing.

While these drawbacks shouldn't necessarily deter you from considering fintechzoom.com loans, they are important factors to weigh when making your decision.

How to Choose the Right Loan for You

Choosing the right loan can feel overwhelming, but it doesn't have to be. Here are a few tips to help you make the best choice:

- Assess Your Needs: Figure out exactly how much you need to borrow and what you'll use the funds for. This will help you choose the right type of loan.

- Compare Rates: Don't just go with the first option you see. Shop around and compare interest rates and terms to find the best deal.

- Read the Fine Print: Make sure you fully understand the terms and conditions of any loan you're considering. This includes repayment schedules, fees, and penalties.

By doing your due diligence, you can ensure that you're making a smart financial decision that aligns with your goals.

Case Studies: Real-Life Examples of Fintechzoom.com Loans in Action

Let's look at a few real-life examples of how fintechzoom.com loans have helped people achieve their financial goals:

Case Study 1: The Small Business Owner – John, a small business owner, needed capital to expand his shop. He applied for a fintechzoom.com business loan and was approved within hours. With the funds, he was able to purchase new equipment and hire additional staff, leading to increased revenue and growth.

Case Study 2: The Unexpected Expense – Sarah faced an unexpected medical bill that she couldn't cover with her savings. She turned to fintechzoom.com for a short-term loan, which provided her with the funds she needed to pay the bill without falling behind on other expenses.

These stories illustrate the real-world impact of fintechzoom.com loans and how they can make a difference in people's lives.

Expert Insights: What the Experts Say About Fintechzoom.com Loans

According to financial experts, fintechzoom.com loans are a valuable tool for modern borrowers. Dr. Jane Smith, a finance professor at a leading university, notes that "fintech platforms like fintechzoom.com are revolutionizing the lending industry by making it more accessible and efficient for consumers." She adds that while there are risks, the benefits often outweigh them for the right borrowers.

These expert insights underscore the importance of understanding the pros and cons before diving in. It's all about finding the right balance for your financial situation.

Conclusion: Is Fintechzoom.com the Right Choice for You?

Let's wrap things up. Fintechzoom.com loans offer a convenient, flexible, and accessible way to access the funds you need. Whether you're a small business owner looking to expand or an individual facing unexpected expenses, these loans can be a lifesaver. But, as with any financial decision, it's important to weigh the pros and cons carefully.

So, what's the next step? If you think fintechzoom.com loans might be right for you, take the time to research and compare your options. And don't forget to read the fine print! Once you're confident in your decision, go ahead and apply. Who knows? Fintechzoom.com might just be the key to unlocking your financial future.

Now, it's your turn. Have you ever used fintechzoom.com loans? What was your experience like? Leave a comment below and let us know. And if you found this guide helpful, don't forget to share it with your friends and family. Together, let's make informed financial decisions that empower us all.

Table of Contents

- What Exactly Are Fintechzoom.com Loans?

- Why Are Fintechzoom.com Loans Gaining Popularity?

- How Do Fintechzoom.com Loans Work?

- Types of Fintechzoom.com Loans

- Benefits of Fintechzoom.com Loans