Aflac: The Comprehensive Guide To Understanding Your Financial Safety Net

When it comes to safeguarding your financial future, Aflac stands out as a name that resonates with trust and reliability. Whether you're exploring supplemental insurance options or simply looking to understand the nuances of Aflac's offerings, this article dives deep into everything you need to know. From its humble beginnings to its current status as a leader in supplemental insurance, Aflac has carved out a niche for itself in the world of financial protection.

Let’s face it, life can throw curveballs when you least expect them. Whether it’s an unexpected illness, a sudden injury, or even a minor accident, these events can wreak havoc on your finances. That’s where Aflac comes in. Founded with the mission to provide peace of mind, Aflac has become synonymous with supplemental insurance solutions that help individuals and families weather life’s unexpected storms.

Now, you might be wondering, "What makes Aflac so special?" Well, buckle up because we’re about to break it down for you. In this guide, we’ll explore everything from Aflac’s history and core offerings to how it fits into your financial safety net. So, whether you’re a seasoned insurance pro or just dipping your toes into the world of supplemental coverage, this article’s got you covered.

Read also:Exploring The World Of Eromecom And Kawaiisofey A Deep Dive

Table of Contents

- Aflac's History: From Ducks to Dollars

- Understanding Aflac's Core Products

- Why Choose Aflac Over Other Insurers?

- Aflac’s Financial Stability: Trust You Can Rely On

- Customer Experience: What Do People Say About Aflac?

- Breaking Down Costs and Coverage Plans

- Navigating the Claim Process with Aflac

- Aflac Through Your Employer: Is It Worth It?

- Long-Term Benefits of Choosing Aflac

- Final Thoughts: Why Aflac Might Be Your Best Bet

Aflac's History: From Ducks to Dollars

Every great story has a beginning, and Aflac’s journey is no exception. Founded in 1955 by three brothers—John, Paul, and William Amos—the company initially started as American Family Life Assurance Company. Yep, that’s where the "Aflac" acronym comes from. But how did a small insurance company grow into the global powerhouse it is today? Let’s rewind the clock and take a trip down memory lane.

Back in the day, the Amos brothers recognized a gap in the insurance market. Traditional health insurance often left policyholders high and dry when it came to covering out-of-pocket expenses. Enter Aflac, which introduced supplemental insurance policies designed to fill those gaps. Over the years, the company expanded its offerings, ventured into international markets, and even adopted its iconic duck mascot in 1995. Who knew a quacking duck could become such a beloved symbol of financial security?

Key Milestones in Aflac's Journey

- 1955: Aflac is founded by the Amos brothers.

- 1988: The company goes public, marking a significant milestone in its growth.

- 1995: The Aflac Duck is introduced, becoming an instant hit in advertising campaigns.

- 2000s: Aflac expands its footprint globally, particularly in Japan, where it becomes a market leader.

Today, Aflac serves millions of customers worldwide, offering a range of supplemental insurance products tailored to meet the diverse needs of individuals and families. But its roots remain firmly planted in the mission of providing peace of mind and financial protection.

Understanding Aflac's Core Products

So, what exactly does Aflac offer? At its core, Aflac specializes in supplemental insurance products designed to complement traditional health insurance. These policies provide a safety net by paying cash benefits directly to policyholders when they experience covered events such as illnesses, injuries, or surgeries. Let’s break down some of the key products offered by Aflac.

Popular Aflac Products

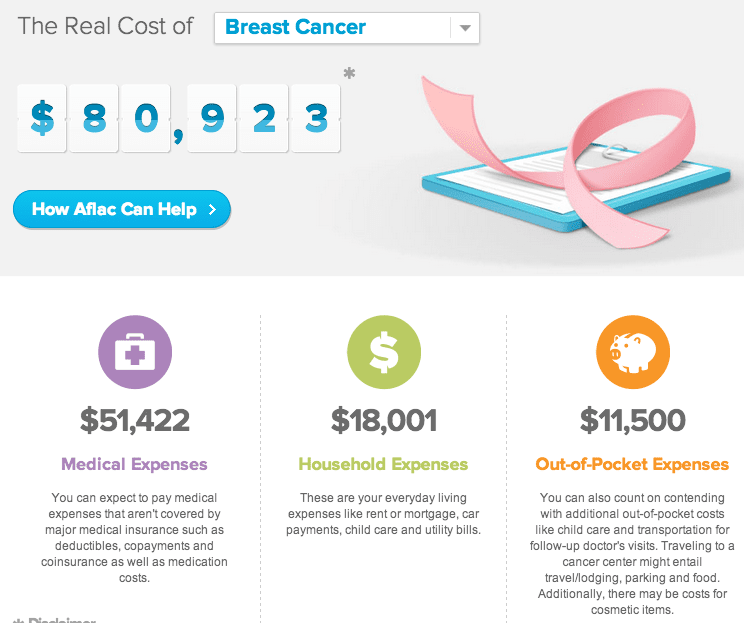

- Critical Illness Insurance: Covers major health events like cancer, heart attacks, and strokes.

- Accident Insurance: Provides financial support in case of accidental injuries.

- Hospital Insurance: Offers coverage for hospital stays and related expenses.

- Cancer Insurance: Specifically designed to help cover costs associated with cancer treatment.

Each of these products is crafted to address specific needs, ensuring that policyholders have the financial resources to focus on recovery rather than worrying about mounting medical bills. And let’s be real, who wouldn’t want that kind of peace of mind?

Why Choose Aflac Over Other Insurers?

In a crowded insurance market, standing out can be a challenge. So, what sets Aflac apart from the competition? For starters, Aflac’s focus on supplemental insurance positions it as a leader in this niche. Unlike traditional health insurers, Aflac doesn’t dictate where you seek treatment or limit your choices. Instead, it provides straightforward cash benefits that you can use however you see fit.

Read also:Somali Wasmo Telegram List Your Ultimate Guide To Discovering The Latest Hype

But that’s not all. Aflac’s reputation for reliability and customer service further solidifies its position as a top choice for many. In fact, surveys consistently rank Aflac high in terms of customer satisfaction, thanks in part to its seamless claim process and dedicated support team.

Advantages of Choosing Aflac

- Quick and easy claim processing.

- Flexible use of cash benefits.

- Wide range of customizable coverage options.

- Strong financial stability and backing.

Whether you’re self-employed, part of a corporate workforce, or simply looking to enhance your existing insurance coverage, Aflac offers solutions tailored to fit your unique situation.

Aflac’s Financial Stability: Trust You Can Rely On

When it comes to insurance, financial stability is everything. After all, you want to ensure that the company backing your policy is as reliable as the coverage itself. Aflac has consistently demonstrated strong financial health, earning high ratings from reputable agencies like Standard & Poor’s and Moody’s. These ratings reflect Aflac’s ability to meet its financial obligations and provide long-term security for its policyholders.

But don’t just take our word for it. According to a recent report, Aflac boasts a robust balance sheet with billions in assets under management. This financial muscle allows the company to weather economic storms and continue delivering on its promises, even in uncertain times.

Key Financial Metrics

- Total assets exceeding $120 billion.

- Consistent profitability year over year.

- Strong cash reserves to handle claims efficiently.

With numbers like these, it’s no wonder Aflac is trusted by millions of individuals and businesses worldwide.

Customer Experience: What Do People Say About Aflac?

At the end of the day, the proof is in the pudding—or in this case, the reviews. Aflac’s commitment to customer satisfaction is evident in the testimonials and feedback from its policyholders. Many customers rave about the ease of filing claims, the speed of receiving payments, and the overall support provided by Aflac’s team.

Of course, no company is perfect, and Aflac is no exception. Some users have expressed concerns about premium costs or specific policy limitations. However, the overwhelming majority of feedback highlights Aflac’s strengths in delivering reliable, customer-focused service.

What Customers Love About Aflac

- Transparent policy terms and conditions.

- Dedicated customer service representatives.

- Timely and efficient claims processing.

Ultimately, Aflac’s emphasis on building long-term relationships with its customers sets it apart in an industry often plagued by skepticism and distrust.

Breaking Down Costs and Coverage Plans

Now, let’s talk dollars and cents. One of the most common questions people have about Aflac is, "How much does it cost?" The answer, as with most insurance products, depends on several factors, including the type of coverage you choose, your age, and your overall health. However, Aflac generally offers competitive pricing that makes its products accessible to a wide range of individuals.

For example, a basic accident insurance policy might cost as little as $20 per month, while more comprehensive critical illness coverage could range from $50 to $100 per month, depending on the level of benefits selected. It’s important to note that these figures are estimates and may vary based on individual circumstances.

Tips for Choosing the Right Plan

- Assess your specific needs and potential risks.

- Compare multiple plans to find the best fit for your budget.

- Consider adding riders for additional coverage options.

By taking the time to evaluate your options and understanding the costs involved, you can make an informed decision that aligns with your financial goals.

Navigating the Claim Process with Aflac

Let’s face it—filing an insurance claim can be a daunting task. But with Aflac, the process is designed to be as straightforward and stress-free as possible. Whether you’re submitting a claim online, over the phone, or through your employer, Aflac ensures that every step is clearly outlined and easy to follow.

Once your claim is submitted, Aflac’s team gets to work reviewing your case and processing your payment. In many instances, policyholders receive their cash benefits within days of filing, allowing them to focus on recovery without worrying about finances.

Steps to File an Aflac Claim

- Gather all necessary documentation, including medical records and bills.

- Submit your claim through Aflac’s online portal or contact customer service.

- Track the status of your claim and reach out if you have any questions.

By simplifying the claim process, Aflac ensures that its policyholders receive the support they need when they need it most.

Aflac Through Your Employer: Is It Worth It?

Many employers offer Aflac as part of their benefits package, making it convenient for employees to enroll in supplemental insurance plans. But is it worth it to sign up for Aflac through your workplace? The answer, as with most things, depends on your individual circumstances.

Enrolling in Aflac through your employer often comes with added perks, such as pre-tax premium deductions and group rates that can make coverage more affordable. Additionally, having Aflac as part of your benefits package ensures that you’re prepared for life’s unexpected twists and turns.

Pros of Enrolling Through Your Employer

- Convenient enrollment and payment options.

- Potential cost savings through group rates.

- Access to dedicated resources and support.

Ultimately, if your employer offers Aflac as a benefit, it’s worth considering how it fits into your overall financial strategy.

Long-Term Benefits of Choosing Aflac

Investing in Aflac isn’t just about short-term peace of mind; it’s about securing your long-term financial future. By choosing Aflac, you’re taking a proactive step toward protecting yourself and your loved ones from the unexpected. Whether it’s covering medical expenses, paying for everyday bills, or simply having a financial cushion during tough times, Aflac’s supplemental insurance products offer lasting value.

Moreover, Aflac’s commitment to innovation and customer service ensures that its offerings remain relevant and effective in an ever-changing world. As technology evolves and healthcare needs shift, Aflac continues to adapt, providing solutions that meet the demands of modern life.

Final Thoughts: Why Aflac Might Be Your Best Bet

In conclusion, Aflac stands out as a trusted partner in safeguarding your financial future. From its rich history and robust product offerings to its financial stability and commitment to customer satisfaction, Aflac has earned its place as a leader in the supplemental insurance industry. Whether you’re exploring options for yourself or considering enrolling through your employer, Aflac provides peace of mind and protection when you