What Is AFLAC Insurance? Your Ultimate Guide To Understanding AFLAC

Let’s cut to the chase—AFLAC insurance is more than just a funky name or that duck you see on TV. It’s a type of supplemental insurance that provides an extra layer of financial protection when life throws you unexpected curveballs. Whether it’s illness, injury, or something else entirely, AFLAC steps in to help cover those costs that your primary insurance might not touch. But hold up, there’s a lot more to it than that, and we’re about to break it down for you in a way that’s easy to digest.

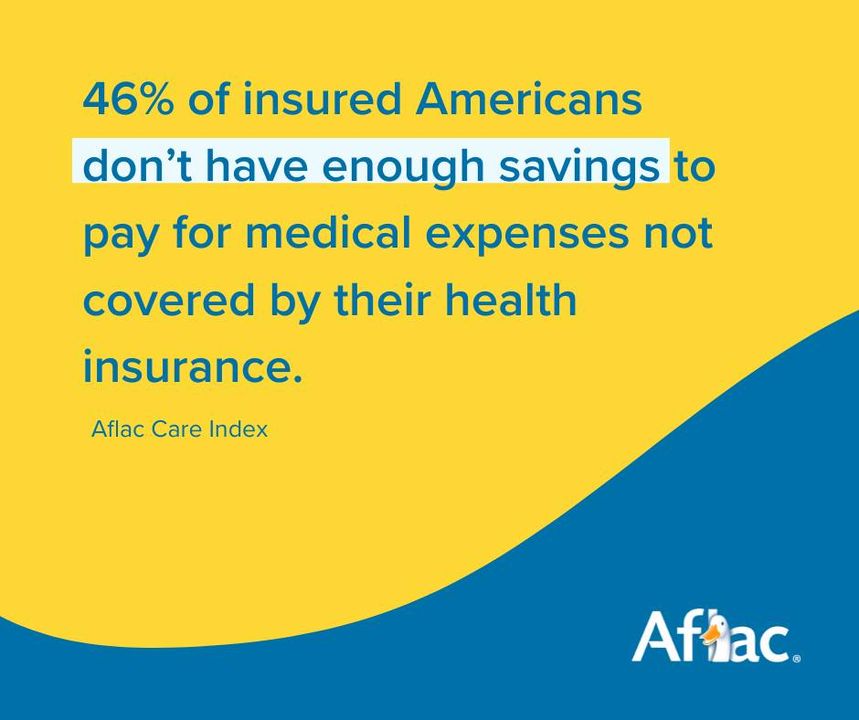

Now, I know what you’re thinking. “Why do I need another insurance when I already have health coverage?” Great question! The truth is, traditional health insurance doesn’t always pick up the tab for everything. That’s where AFLAC comes in, filling those gaps with specialized plans tailored to your specific needs. Think of it as your financial safety net when life gets a little messy.

Whether you’re here because you’ve heard about AFLAC through the grapevine or you’re actively shopping around for additional coverage, this guide is going to give you all the deets. Stick around, because we’re diving deep into what AFLAC insurance is, how it works, and why it might just be the smart move you’ve been waiting for.

Read also:Carly Simpkins Wikipedia The Ultimate Guide To Her Life Career And Legacy

Daftar Isi

Benefits of Having AFLAC Coverage

Read also:Rita Faez Erome The Rising Star Of The Digital Age

AFLAC vs. Traditional Insurance

Conclusion: Is AFLAC Right for You?

Overview of AFLAC Insurance

Alright, let’s start with the basics. AFLAC insurance is a supplemental insurance provider that focuses on helping individuals and families manage out-of-pocket expenses related to medical conditions or accidents. It’s not meant to replace your primary health insurance but rather to complement it by covering things like deductibles, lost wages, and other expenses that can pile up when you’re dealing with a health issue.

One of the coolest things about AFLAC is its flexibility. They offer a variety of plans, so you can pick the ones that fit your lifestyle and budget. Whether it’s accident insurance, critical illness insurance, or cancer coverage, there’s something for everyone. Plus, their policies are designed to pay you cash benefits directly, giving you the freedom to use the money however you see fit.

Why Choose AFLAC?

There are plenty of reasons why people choose AFLAC. Here are a few:

- Simple Payouts: No waiting for approval from your primary insurance. AFLAC pays you directly.

- Customizable Plans: Tailor your coverage to fit your needs.

- Wide Range of Options: From cancer insurance to hospital confinement coverage, AFLAC’s got you covered.

AFLAC’s History and Evolution

Let’s rewind the clock a bit. AFLAC started way back in 1955 as the American Family Life Assurance Company of Columbus. The founders, three brothers named John, Bill, and Jimmy Amos, saw a need for affordable insurance options for working families. Fast forward to today, and AFLAC has grown into a global powerhouse, serving millions of customers across the United States and Japan.

One of the most iconic parts of AFLAC’s history is, of course, the Aflac Duck. Introduced in 2000, this quacking mascot became a household name and helped boost brand recognition. The duck’s catchy quip, “Aflac!” became synonymous with the company, making it one of the most recognizable brands in the insurance industry.

How Has AFLAC Evolved?

Over the years, AFLAC has expanded its offerings and embraced technology to better serve its customers. They’ve introduced digital tools for easier enrollment, policy management, and claim filing. Plus, they’ve continuously updated their product lineup to stay relevant in an ever-changing healthcare landscape.

Types of AFLAC Insurance

Now, let’s talk about the different types of AFLAC insurance available. There’s something for almost every scenario you can imagine. Here’s a quick rundown:

Cancer Insurance

This policy provides coverage for cancer-related expenses, including treatments, hospital stays, and even travel costs. It’s a lifesaver for those facing a cancer diagnosis, offering financial peace of mind during a tough time.

Critical Illness Insurance

Similar to cancer insurance, this plan covers a broader range of serious illnesses, such as heart attacks, strokes, and more. It gives you cash benefits to help with medical bills and other costs associated with critical conditions.

Accident Insurance

Accidents happen, and when they do, the costs can add up fast. AFLAC’s accident insurance helps cover expenses like emergency room visits, surgeries, and rehabilitation. It’s a great option for active individuals or families with kids.

Hospital Confinement Insurance

Being hospitalized can be expensive, even with health insurance. This policy pays you a lump sum if you’re admitted to the hospital, helping you cover those unexpected bills.

Benefits of Having AFLAC Coverage

So, why should you consider AFLAC insurance? Here are some of the top benefits:

- Financial Security: Knowing you’re covered for unexpected medical expenses can give you peace of mind.

- Flexibility: Use the cash benefits however you want—whether it’s for medical bills, groceries, or even a vacation.

- Comprehensive Protection: AFLAC offers a wide range of plans to cover almost any situation.

How Does AFLAC Benefit Families?

Families often face unique challenges when it comes to healthcare costs. With AFLAC, parents can rest easy knowing their kids are covered for accidents, illnesses, and more. Plus, the cash benefits can help cover daycare costs, lost wages, or even home repairs if an accident occurs.

How AFLAC Insurance Works

Let’s break down the process of how AFLAC insurance works. First, you enroll in a plan that fits your needs. Once you’re enrolled, if you experience a covered event, you file a claim with AFLAC. They’ll review your claim and, if approved, send you a check or direct deposit the funds into your account.

It’s important to note that AFLAC policies are typically straightforward and easy to understand. Unlike some traditional insurance plans, there’s no hassle with co-pays or networks. You get paid directly, and you decide how to use the money.

Steps to File a Claim

Filing a claim with AFLAC is simple:

- Submit your claim online or by mail.

- Include any necessary documentation, such as medical records or accident reports.

- Wait for AFLAC to review your claim and issue payment.

Eligibility and Enrollment

Who can enroll in AFLAC insurance? Pretty much anyone! While some plans may have specific eligibility requirements, most are open to individuals, families, and even employers looking to offer additional benefits to their employees.

Enrollment can be done through your employer if they offer AFLAC as part of their benefits package. If not, you can enroll directly through AFLAC’s website or by contacting a representative.

Tips for Enrollment

Here are a few tips to make the enrollment process smoother:

- Review all available plans carefully to choose the best fit for your needs.

- Ask questions if you’re unsure about anything—AFLAC reps are there to help!

- Consider your budget and prioritize the coverage that matters most to you.

Cost and Pricing Factors

One of the most common questions people have is, “How much does AFLAC insurance cost?” The answer depends on several factors, including the type of plan, coverage amount, and your age. Generally, AFLAC policies are affordable, especially when compared to the potential costs of uncovered medical expenses.

Pricing can vary based on where you live and whether you’re enrolling through an employer or individually. Some employers may even offer premium discounts as part of their benefits package.

Factors Affecting Cost

Here are a few things that can impact the cost of your AFLAC policy:

- Your age and health history.

- The level of coverage you choose.

- Whether you enroll through an employer or individually.

AFLAC vs. Traditional Insurance

How does AFLAC stack up against traditional health insurance? Well, they serve different purposes. Traditional insurance typically covers medical expenses directly, while AFLAC pays you cash benefits to help with any related costs. Think of it as a team effort—your primary insurance handles the big stuff, and AFLAC takes care of the rest.

Another key difference is that AFLAC doesn’t require you to use specific providers or networks. You’re free to seek care wherever you choose, and the cash benefits are yours to use however you see fit.

Which One Should You Choose?

The best option depends on your individual needs. If you already have solid health insurance but want extra protection, AFLAC is a great choice. If you’re looking for comprehensive coverage, you’ll likely need both.

Filing Claims with AFLAC

Filing claims with AFLAC is a breeze. Their online portal makes it easy to submit your claim and track its progress. Plus, their customer service team is always available to assist if you run into any issues.

Once your claim is approved, you’ll typically receive your payment within a few days. It’s fast, efficient, and hassle-free—a big win in the world of insurance.

Tips for Successful Claims

Here are a few tips to ensure your claims go smoothly:

- Keep all relevant documentation handy.

- Submit your claim as soon as possible after a covered event.

- Double-check all information for accuracy before submitting.

FAQs About AFLAC Insurance

Still have questions? Here are some common ones we hear about AFLAC insurance:

Is AFLAC Insurance Worth It?

For many people, yes! It provides an extra layer of financial protection that can make a big difference during tough times.

Can I Enroll in Multiple Plans?

Absolutely! Many people choose to enroll in multiple AFLAC plans to ensure they’re fully covered for various scenarios.

What Happens If I Cancel My Policy?

You can cancel your policy at any time, but keep in mind that you’ll no longer be covered for new claims. Any unused premiums may be refunded, depending on your policy terms.

Conclusion: Is AFLAC Right for You?

Wrapping it all up, AFLAC insurance is a fantastic option for anyone looking to bolster their financial protection. Whether it’s cancer insurance, accident coverage, or something else entirely, AFLAC offers flexible, affordable plans that can make a real difference in your life.

So, are you ready to take the next step? Consider your needs, explore the available options, and don’t hesitate to reach out to AFLAC for more info. And remember, when life gets unpredictable, having that extra layer of security can be a game-changer.

Got thoughts or questions? Drop a comment below or share this article with someone who might benefit from it. Together, let’s make smart financial decisions that protect our futures!