How Does Gerber College Plan Work? Your Ultimate Guide To Securing Your Child's Future

Let’s face it, parents. College is no joke. It’s expensive, competitive, and can feel like a never-ending financial burden. But what if there was a way to prepare for it without breaking the bank? Enter the Gerber College Plan. Yep, you heard that right. This isn’t just some random scheme—it’s a legit, time-tested solution that’s been helping families for decades. If you’re scratching your head wondering how does Gerber College Plan work, don’t sweat it. We’ve got all the answers you need right here.

Now, before we dive deep into the nitty-gritty, let’s get one thing straight: the Gerber College Plan isn’t just about saving money. It’s about creating a safety net for your child’s future. Think of it as an investment in their dreams, their education, and ultimately, their life. And trust me, in today’s world, that’s priceless.

But here’s the deal: not everyone knows how this plan works or why it’s such a game-changer. That’s where we come in. In this article, we’re going to break it down for you step by step so you can make an informed decision for your family. So grab a coffee, sit back, and let’s figure out how the Gerber College Plan can work wonders for you.

Read also:Kawaiisofey Eroke A Deep Dive Into The Phenomenon You Cant Ignore

Here’s a quick roadmap of what we’ll cover:

- What Is the Gerber College Plan?

- How Does Gerber College Plan Work?

- Benefits of the Gerber College Plan

- Eligibility and Requirements

- Cost and Financing

- Common Questions About Gerber College Plan

- Comparison with Other Plans

- Tips for Maximizing Your Plan

- Real Stories and Testimonials

- Conclusion and Next Steps

What Is the Gerber College Plan?

Alright, let’s start with the basics. The Gerber College Plan is essentially a life insurance policy designed specifically for children. But here’s the twist—it’s not just about life insurance. This plan offers a unique combination of protection and savings, making it a smart choice for parents who want to secure their child’s future.

Here’s how it works in a nutshell: when you enroll your child in the Gerber College Plan, you’re essentially locking in a guaranteed cash value that grows over time. This cash value can later be used to pay for college expenses, buy a car, or even fund a business venture. The best part? The plan is super flexible, meaning you’re not tied down to using the funds for just one purpose.

Now, you might be wondering, “Why Gerber?” Well, Gerber has been in the business of helping families for over 90 years. They’ve earned a reputation for being reliable, trustworthy, and customer-focused. And when it comes to your child’s future, you want nothing less than the best.

Why Choose Gerber Over Other Options?

There are plenty of college savings plans out there, but what sets Gerber apart is its simplicity and flexibility. Unlike 529 plans or traditional savings accounts, the Gerber College Plan offers guaranteed cash value, no matter what happens in the market. Plus, the premiums are affordable, making it accessible for families on a budget.

How Does Gerber College Plan Work?

So, you’re probably thinking, “Okay, sounds great, but how does Gerber College Plan work exactly?” Great question. Let’s break it down step by step:

Read also:Yvonne Elliman And Eric Clapton Relationship A Love Story That Shook The Music World

First things first, you need to enroll your child in the plan. This can be done shortly after birth—yes, even as early as a few days old. Once enrolled, you’ll start paying small, fixed premiums. These premiums accumulate over time, building up the cash value of the policy.

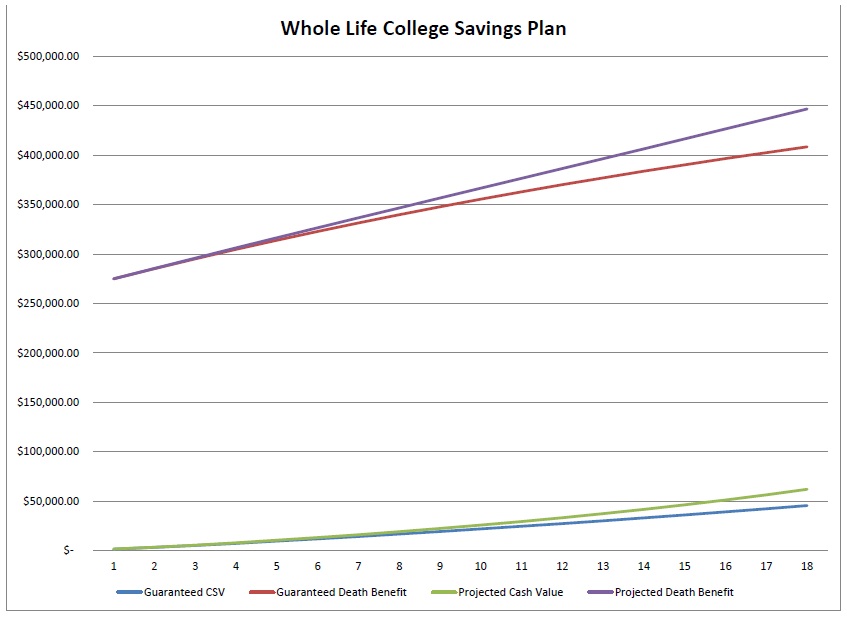

Here’s the kicker: the cash value is guaranteed to grow, regardless of market conditions. That means even if the economy takes a nosedive, your investment remains safe. And when your child is ready for college (or whatever their next step is), you can tap into that cash value to cover expenses.

Key Features of the Gerber College Plan

Let’s take a closer look at what makes the Gerber College Plan so special:

- Guaranteed Cash Value: The cash value grows steadily over time, giving you peace of mind.

- Flexibility: Use the funds for anything—college, a car, or even a down payment on a house.

- Affordable Premiums: The premiums are designed to fit any budget, making it accessible for all families.

- No Market Risk: Unlike other investment options, the Gerber College Plan isn’t affected by market fluctuations.

Benefits of the Gerber College Plan

Now that we know how the Gerber College Plan works, let’s talk about why it’s such a great option for families. Here are some of the top benefits:

First and foremost, it offers financial security. With college costs skyrocketing, having a guaranteed source of funds can make all the difference. Plus, the flexibility of the plan means you’re not locked into one specific use for the money. Whether your child decides to go to college, start a business, or travel the world, the Gerber College Plan has got you covered.

Another major benefit is the peace of mind it provides. Knowing that your child’s future is secure can alleviate a lot of stress and anxiety. And let’s be real, parents need all the peace of mind they can get these days.

Additional Perks

Did you know that the Gerber College Plan also offers life insurance coverage? That’s right, in addition to the savings component, the plan provides a death benefit that can help protect your family in the event of the unthinkable. It’s like a two-for-one deal: savings and protection rolled into one.

Eligibility and Requirements

Alright, so who can sign up for the Gerber College Plan? The good news is, just about anyone can enroll their child. Here are the basic eligibility requirements:

- Your child must be under 4 years old at the time of enrollment.

- You must be a legal guardian or parent of the child.

- You’ll need to complete a simple application process, which includes providing some basic information about your child.

And that’s it! No complicated forms, no lengthy approval processes. It’s designed to be as easy and stress-free as possible.

What If My Child Is Older Than 4?

Unfortunately, the Gerber College Plan is only available to children under 4 years old. However, there are other options out there for older kids, such as 529 plans or traditional savings accounts. But if you’ve got a newborn or toddler, now’s the time to act!

Cost and Financing

Let’s talk money. How much does the Gerber College Plan cost? The good news is, the premiums are surprisingly affordable. Depending on the plan you choose, you could be paying as little as $20 per month. And remember, those premiums are fixed, meaning they won’t increase over time.

Here’s a breakdown of the typical costs:

- Basic Plan: $20-$30 per month

- Standard Plan: $40-$60 per month

- Premium Plan: $70-$100 per month

Of course, the exact cost will depend on factors like your child’s age and the level of coverage you choose. But rest assured, there’s a plan to fit every budget.

How to Pay Your Premiums

Paying your premiums is a breeze. You can set up automatic payments, pay online, or even mail in your payments if you prefer. The key is to stay consistent, as missed payments can affect the growth of your cash value.

Common Questions About Gerber College Plan

Still have questions? Don’t worry, we’ve got answers. Here are some of the most common questions we hear about the Gerber College Plan:

Q: Can I use the funds for anything other than college?

A: Absolutely! The Gerber College Plan gives you the flexibility to use the funds however you see fit. Whether it’s for college, a car, or even a down payment on a house, the choice is yours.

Q: What happens if my child doesn’t go to college?

A: No problem! The cash value is yours to use however you wish, so even if college isn’t in the cards, you can still put that money to good use.

Q: Is the Gerber College Plan safe?

A: Yes, it’s extremely safe. The cash value is guaranteed to grow, and the plan is backed by Gerber Life Insurance Company, a trusted name in the industry.

Comparison with Other Plans

Let’s compare the Gerber College Plan to some other popular options:

When it comes to 529 plans, the Gerber College Plan offers a few key advantages. First, it’s not tied to any specific college or university, giving you more flexibility in how you use the funds. Second, it’s not affected by market fluctuations, making it a safer bet in uncertain times.

Traditional savings accounts, on the other hand, don’t offer the same level of protection or guaranteed growth. Plus, they’re often subject to fees and minimum balance requirements, which can eat into your savings over time.

Why Gerber Stands Out

Here’s the bottom line: the Gerber College Plan offers a unique combination of savings, protection, and flexibility that’s hard to beat. Whether you’re looking to secure your child’s future or simply want peace of mind, it’s a smart choice for any family.

Tips for Maximizing Your Plan

Want to get the most out of your Gerber College Plan? Here are a few tips:

- Start early. The earlier you enroll your child, the more time the cash value has to grow.

- Be consistent with your payments. Missing payments can affect the growth of your cash value, so try to stay on track.

- Consider adding extra payments. If your budget allows, consider making additional payments to boost your cash value even faster.

Real Stories and Testimonials

Don’t just take our word for it—here’s what some real parents have to say about the Gerber College Plan:

“We enrolled our daughter in the Gerber College Plan when she was just a few months old, and it’s been such a blessing. The peace of mind it gives us is priceless.” – Sarah M.

“I was skeptical at first, but after seeing the growth of the cash value over the years, I’m so glad we chose the Gerber College Plan.” – John D.

Conclusion and Next Steps

So there you have it, folks. The Gerber College Plan is a smart, flexible, and reliable way to secure your child’s future. Whether you’re saving for college, a car, or something else entirely, this plan offers the peace of mind and flexibility you need.

Ready to take the next step? Enrolling in the Gerber College Plan is easy. Simply visit their website, fill out the application, and start securing your child’s future today. And remember, the earlier you start, the better.

Got questions or comments? Drop us a line below, and don’t forget to share this article with other parents who might benefit from it. Together, we can help create a brighter future for our kids!