How Does Aflac Work: A Beginner's Guide To Understanding This Popular Supplemental Insurance

Ever wondered how Aflac works and why it's become such a buzzword in the insurance world? If you're scratching your head or just want to know what all the fuss is about, you've come to the right place. Aflac, short for American Family Life Assurance Company, offers a unique type of insurance that provides financial assistance when traditional health coverage falls short. So, let's dive in and unravel the mystery of Aflac together!

Aflac's supplemental insurance isn't your run-of-the-mill health plan. Instead, it acts as a safety net, paying cash benefits directly to you when you experience certain covered events, like hospital stays or surgeries. It's like having a financial buddy in your corner when life throws unexpected curveballs.

Whether you're a working professional, a small business owner, or just someone looking for extra protection, understanding how Aflac works can help you make smarter financial decisions. Let's break it down step by step so you can see why millions of people trust Aflac to cover their backs.

Read also:Carly Simpkins Wikipedia The Ultimate Guide To Her Life Career And Legacy

What Exactly Is Aflac?

Alright, let's start with the basics. Aflac isn't your typical insurance company; it specializes in supplemental insurance, which is designed to complement your primary health coverage. Think of it as an extra layer of protection that kicks in when your main insurance doesn't cover all the costs. Here's a quick rundown:

- Aflac offers cash benefits for specific covered events, such as cancer, accidents, or hospital stays.

- These cash payments can be used however you see fit—whether it's for medical bills, daily living expenses, or even a vacation!

- It's available for individuals, families, and businesses, making it a versatile option for almost anyone.

And guess what? Aflac isn't just in the U.S.; it also operates in Japan, where it's the leading provider of supplemental insurance. So yeah, they're kind of a big deal globally.

Why Do People Choose Aflac?

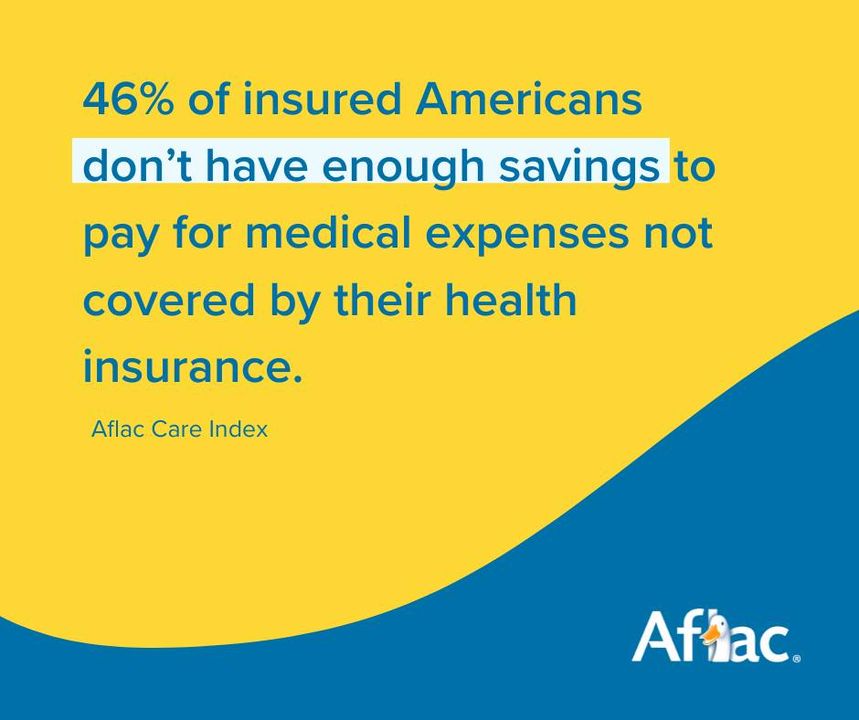

Now, you might be thinking, "Why would I need Aflac if I already have health insurance?" Great question! The truth is, traditional health insurance often leaves gaps that can lead to unexpected out-of-pocket expenses. Aflac steps in to fill those gaps, giving you peace of mind.

Here are some reasons why people love Aflac:

- Cash Payments: Aflac pays you directly, so you have the freedom to use the money however you need.

- Simple Claims Process: Filing a claim with Aflac is straightforward, and many customers receive their benefits within days.

- Wide Range of Coverage: From critical illnesses to accidents, Aflac offers a variety of plans to suit different needs.

Plus, who doesn't love the iconic Aflac duck? That little guy has been around since 2000, and he's become a symbol of the company's commitment to helping people through tough times.

How Does Aflac Supplemental Insurance Work?

Let's get into the nitty-gritty of how Aflac actually works. When you purchase an Aflac policy, you're essentially buying protection against specific events that could disrupt your financial stability. Here's how it breaks down:

Read also:Telegram Wasmo Somali 2025 The Ultimate Guide To Exploring The Future Of Digital Communication

First, you choose a plan that suits your needs. Aflac offers various options, including:

- Critical illness insurance

- Hospital confinement insurance

- Accident insurance

- Cancer insurance

Once you've selected a plan, you pay a premium based on the level of coverage you choose. If you experience a covered event, Aflac will review your claim and, if approved, send you a cash payment. It's that simple!

What Kinds of Events Does Aflac Cover?

Aflac covers a wide range of events, depending on the specific policy you choose. Here are some examples:

- Hospital stays

- Surgeries

- Cancer diagnosis

- Accidents resulting in injury

- Chronic illnesses

Each policy has its own set of covered events, so it's important to read the fine print and understand what's included in your plan.

How Much Does Aflac Cost?

One of the most common questions people have is, "How much does Aflac cost?" The answer depends on several factors, including:

- The type of coverage you choose

- Your age and health status

- The amount of coverage you want

For example, accident insurance might cost less than critical illness insurance because the risks and benefits differ. Aflac offers flexible payment options, so you can choose a plan that fits your budget.

On average, Aflac premiums range from $20 to $100 per month, but this can vary widely depending on your situation. The best way to get an accurate estimate is to contact Aflac directly or use their online quote tool.

Is Aflac Worth the Money?

Whether Aflac is worth the money depends on your individual circumstances. If you have a solid health insurance plan and rarely encounter major medical issues, you might not need supplemental coverage. However, if you're someone who frequently deals with unexpected medical expenses, Aflac could be a lifesaver.

Consider this: According to a survey by Aflac, 62% of Americans say they would struggle to cover a $1,000 unexpected expense. Aflac helps bridge that gap, giving you financial security when you need it most.

How to File an Aflac Claim

Filing an Aflac claim is relatively straightforward, but it's important to understand the process to avoid delays. Here's what you need to do:

- Contact Aflac as soon as possible after experiencing a covered event.

- Gather all necessary documentation, such as medical records or accident reports.

- Submit your claim online, by mail, or over the phone.

- Wait for Aflac to review your claim and issue a decision.

Aflac aims to process claims quickly, often within a few days. If your claim is approved, you'll receive your cash payment directly, usually via check or direct deposit.

Common Reasons for Claim Denials

While Aflac strives to approve claims promptly, there are situations where a claim might be denied. Some common reasons include:

- Failure to submit required documentation

- The event isn't covered under your policy

- Missed deadlines for filing the claim

To avoid these issues, make sure you understand your policy's terms and follow the claims process carefully.

Is Aflac Legit? Understanding Its Reputation

With so many insurance options out there, it's natural to wonder, "Is Aflac legit?" The short answer is yes, Aflac is a legitimate and reputable company. Founded in 1955, it has a long history of providing quality insurance products to millions of customers worldwide.

Aflac is highly rated by industry experts, including A.M. Best, which assigns it an A+ (Superior) rating. This rating reflects the company's financial strength and ability to meet its obligations to policyholders.

Of course, like any large company, Aflac isn't without its critics. Some customers have complained about slow claims processing or difficulty understanding policy terms. However, the overwhelming majority of feedback is positive, with many people praising Aflac's customer service and reliability.

What Do Customers Say About Aflac?

Customer reviews can provide valuable insights into Aflac's performance. Here are a few highlights from real Aflac users:

- "Aflac paid my claim within days, and the money really helped when I was out of work due to surgery."

- "I was skeptical at first, but the cash benefits have been a lifesaver for unexpected medical bills."

- "Their customer service team is always friendly and easy to work with."

While not every experience is perfect, the majority of Aflac customers seem satisfied with their coverage and service.

How Does Aflac Compare to Other Insurance Providers?

When it comes to supplemental insurance, Aflac isn't the only game in town. But how does it stack up against competitors? Here's a quick comparison:

- Coverage Options: Aflac offers a wide range of plans, including accident, critical illness, and hospital confinement insurance.

- Claims Process: Aflac is known for its fast claims processing and straightforward procedures.

- Customer Service: Aflac consistently ranks high in customer satisfaction surveys.

That said, other providers may offer lower premiums or different coverage options, so it's always a good idea to shop around and compare before making a decision.

Should You Choose Aflac Over Other Providers?

Choosing the right insurance provider depends on your specific needs and priorities. If you value comprehensive coverage, reliable claims processing, and excellent customer service, Aflac is a strong contender. However, if cost is your primary concern, you might want to explore other options as well.

Ultimately, the best way to decide is to compare quotes, read reviews, and consult with a trusted insurance professional.

Conclusion: Is Aflac Right for You?

In conclusion, Aflac offers a valuable solution for anyone looking to protect themselves from unexpected medical expenses. Its supplemental insurance plans provide cash benefits when you need them most, giving you the financial freedom to focus on recovery rather than bills.

So, is Aflac right for you? If you're someone who values peace of mind and wants to ensure you're covered in case of emergencies, it's definitely worth considering. Take the time to research your options, compare plans, and talk to an Aflac representative to find the best fit for your needs.

Don't forget to leave a comment or share this article if you found it helpful! And if you're ready to take the next step, visit Aflac's website or contact them directly to get started. Your financial security is too important to ignore!

Table of Contents

- What Exactly Is Aflac?

- Why Do People Choose Aflac?

- How Does Aflac Supplemental Insurance Work?

- How Much Does Aflac Cost?

- How to File an Aflac Claim

- Is Aflac Legit?

- How Does Aflac Compare to Other Insurance Providers?

- Conclusion