Aflac Insurance: Your Ultimate Guide To Comprehensive Coverage

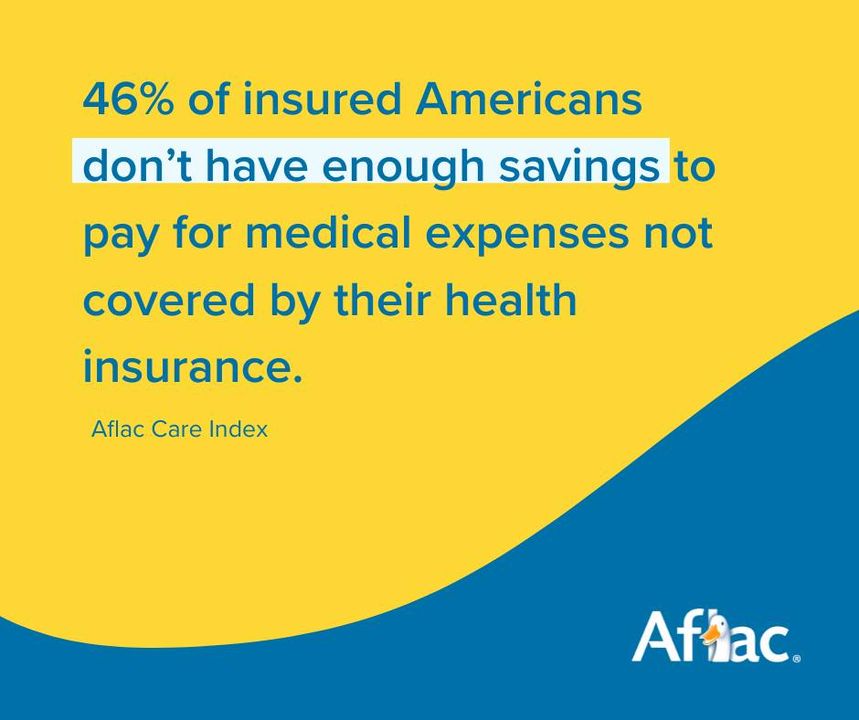

When it comes to protecting yourself and your loved ones, Aflac insurance stands out as a reliable partner. Whether you're looking for supplemental health coverage or planning for unexpected expenses, Aflac offers solutions tailored to fit your needs. In today's unpredictable world, having the right insurance can make all the difference. Let's dive into what makes Aflac so unique and why millions of people trust them.

Aflac isn't just another insurance company—it's a name synonymous with financial security and peace of mind. Founded back in 1955, this powerhouse has been helping individuals and families safeguard their futures against unforeseen medical costs. So whether you're dealing with an injury, illness, or any other life event, Aflac steps in to cover those gaps traditional health insurance might miss.

But hold up—what exactly does Aflac offer? How does it work? And most importantly, is it worth considering for your personal protection plan? Stick around because we're about to break it all down for you. From its history to its products and everything in between, this guide will give you the lowdown on why Aflac could be the missing piece in your financial safety net.

Read also:Hannah Stocking And Klay Thompson The Love Story Thatrsquos Got Everyone Talking

Here’s a quick snapshot of what we’ll cover:

- The Story Behind Aflac Insurance

- Types of Aflac Insurance Plans

- Key Benefits of Aflac Coverage

- Understanding Aflac Insurance Costs

- Who’s Eligible for Aflac Policies?

- How to File an Aflac Insurance Claim

- Aflac vs. Other Insurance Providers

- Customer Reviews and Feedback

- Tips for Maximizing Your Aflac Policy

- Frequently Asked Questions About Aflac

The Story Behind Aflac Insurance

Before we get into the nitty-gritty of Aflac's offerings, let's take a trip down memory lane. Aflac started way back in 1955 under the name American Family Life Assurance Company. It was founded by three brothers—John, William, and Paul Amos—who had a vision of providing affordable insurance solutions to everyday Americans. Over the years, Aflac grew exponentially, becoming one of the largest providers of supplemental insurance in the United States.

One interesting tidbit? The iconic Aflac duck wasn't part of the brand until the late '90s. Introduced in 1999, the duck became the company's mascot and played a pivotal role in boosting brand recognition. The quirky commercials featuring the talking duck helped cement Aflac's place in pop culture while reinforcing its message of reliability and support.

Why Aflac Gained Popularity

Aflac's rise in popularity can be attributed to several factors:

- Its focus on supplemental insurance products that complement existing health plans.

- An emphasis on customer satisfaction through fast claims processing and personalized service.

- Innovative marketing strategies, including the unforgettable Aflac duck campaign.

Today, Aflac continues to evolve, offering cutting-edge policies that cater to modern-day challenges. With millions of satisfied customers worldwide, it's no surprise that Aflac remains a top choice for supplemental insurance.

Types of Aflac Insurance Plans

Now that we know where Aflac comes from, let's talk about what they actually offer. Aflac specializes in supplemental insurance plans designed to fill the gaps left by traditional health insurance. Here's a rundown of their most popular options:

Read also:Exploring The World Of Eromecom And Kawaiisofey A Deep Dive

1. Accident Insurance

Accidents happen, and when they do, medical bills can pile up fast. Aflac's accident insurance provides coverage for unexpected expenses related to injuries, including hospital stays, surgeries, and rehabilitation. This policy pays out cash benefits directly to you, giving you the flexibility to use the funds however you need.

2. Critical Illness Insurance

Dealing with a serious illness like cancer or heart disease can be financially draining. Aflac's critical illness insurance offers lump-sum payments to help cover treatment costs, travel expenses, and even everyday bills during recovery. It's a safety net that ensures you can focus on healing without worrying about money.

3. Hospital Insurance

Hospital stays can be expensive, even with primary health insurance. Aflac's hospital insurance pays benefits for each day you're admitted to the hospital, helping offset costs associated with your stay. This policy is especially beneficial for those who frequently require hospital care.

4. Life Insurance

Aflac also offers life insurance policies that provide financial security for your loved ones after you're gone. Whether you want to leave behind a legacy or ensure your family's future, Aflac's life insurance plans offer peace of mind.

Key Benefits of Aflac Coverage

So, what makes Aflac stand out from the competition? Here are some of the top benefits of choosing Aflac insurance:

- Direct Cash Payments: Aflac pays benefits directly to you, allowing you to use the money as you see fit.

- Fast Claims Processing: Aflac is known for its speedy claims process, often paying out within days of receiving your paperwork.

- Flexible Plans: You can customize your coverage to suit your specific needs and budget.

- Comprehensive Support: Aflac offers a wide range of policies to address various life events and medical conditions.

These advantages make Aflac a go-to option for individuals seeking reliable supplemental insurance.

Understanding Aflac Insurance Costs

One of the biggest concerns people have when considering insurance is cost. Aflac's pricing varies based on several factors, including the type of policy, coverage amount, and individual circumstances. While it's impossible to pinpoint an exact price without a personalized quote, here's a general idea of what you might expect:

Factors Affecting Premiums

- Age

- Health history

- Policy type

- Coverage level

- Geographical location

It's important to note that Aflac offers competitive rates, especially when compared to other supplemental insurance providers. Plus, many employers offer Aflac policies as part of their benefits package, which can lead to additional savings.

Who’s Eligible for Aflac Policies?

Another common question is: Who can sign up for Aflac insurance? Generally speaking, anyone can apply for Aflac coverage, but eligibility requirements may vary depending on the policy. For example:

- Accident and critical illness insurance are typically available to individuals aged 18–65.

- Hospital insurance may have slightly different age restrictions.

- Life insurance policies are often available to people of all ages, provided they meet certain health criteria.

Additionally, Aflac offers group policies through employers, making it easier for employees to access affordable coverage.

How to File an Aflac Insurance Claim

Filing an Aflac insurance claim is straightforward and user-friendly. Here's a step-by-step guide to help you navigate the process:

- Gather all necessary documentation, including medical records, bills, and receipts.

- Log in to your Aflac account or contact customer service for assistance.

- Submit your claim online or via mail, ensuring all information is accurate and complete.

- Monitor the status of your claim through your account dashboard.

Aflac prides itself on its quick claims processing, so you can expect a decision within a matter of days. If you encounter any issues, their dedicated support team is always ready to assist.

Aflac vs. Other Insurance Providers

While Aflac is a leader in the supplemental insurance space, there are other providers offering similar products. So how does Aflac stack up against the competition?

One major advantage Aflac has is its focus on customer service. Their commitment to fast claims processing and personalized support sets them apart from many competitors. Additionally, Aflac's wide range of policies ensures there's something for everyone, regardless of your specific needs.

That said, it's always a good idea to shop around and compare quotes before making a final decision. By doing so, you can ensure you're getting the best value for your money.

Customer Reviews and Feedback

Word of mouth plays a huge role in choosing the right insurance provider. Fortunately, Aflac boasts a wealth of positive reviews from satisfied customers. Many praise the company for its prompt claims handling, friendly representatives, and reliable coverage.

Of course, like any business, Aflac isn't without its detractors. Some customers have expressed frustration with denied claims or unexpected policy exclusions. However, these instances are relatively rare compared to the overwhelmingly positive feedback Aflac receives.

Tips for Maximizing Your Aflac Policy

Once you've secured an Aflac policy, there are steps you can take to get the most out of your coverage:

- Thoroughly review your policy documents to understand exactly what's covered.

- Keep detailed records of all medical expenses and interactions with healthcare providers.

- File claims promptly and accurately to avoid delays in payment.

- Take advantage of Aflac's online tools and resources to manage your account efficiently.

By following these tips, you can ensure your Aflac policy works as effectively as possible for you and your family.

Frequently Asked Questions About Aflac

Still have questions about Aflac insurance? Here are some answers to common queries:

Q: Is Aflac insurance necessary if I already have health insurance?

A: Yes! Supplemental insurance like Aflac fills gaps left by traditional health plans, providing extra protection against unexpected costs.

Q: Can I cancel my Aflac policy at any time?

A: Absolutely. Most Aflac policies come with no long-term commitments, allowing you to cancel whenever you choose.

Q: How long does it take to receive my first claim payment?

A: Typically, Aflac processes claims within days of submission, ensuring you receive your benefits quickly.

And there you have it—an in-depth look at Aflac insurance and everything it has to offer. Whether you're considering supplemental coverage for yourself or your family, Aflac provides reliable solutions to help protect your financial future.

Conclusion

In summary, Aflac insurance offers a robust lineup of supplemental policies designed to address the unique needs of modern consumers. From accident and critical illness coverage to hospital and life insurance, Aflac ensures you're prepared for whatever life throws your way.

Don't wait for the unexpected to strike—take action today by exploring Aflac's offerings and securing the protection you deserve. Leave a comment below sharing your thoughts or experiences with Aflac, and be sure to check out other articles on our site for more valuable insights into insurance and personal finance.