Aflac Benefits: The Ultimate Guide To Unlocking Financial Security

Hey there, folks! If you're reading this, chances are you've stumbled upon the term "Aflac benefits" and you're wondering what all the fuss is about. Let's dive right into it. Aflac benefits are like your secret weapon when life throws unexpected curveballs your way. Think of it as a financial safety net that helps you cover those expenses that your regular health insurance might not touch. And trust me, in today's world, having that extra layer of protection is more important than ever.

Now, before we get into the nitty-gritty, let's break it down for you. Aflac is not just another insurance company; it's a powerhouse that specializes in supplemental insurance policies. Whether you're dealing with medical bills, lost income, or other unexpected costs, Aflac benefits are designed to step in and make your life a little less stressful. So, buckle up because we're about to uncover everything you need to know.

What makes Aflac benefits truly unique is their simplicity and flexibility. Unlike some insurance policies that come with pages of fine print, Aflac keeps things straightforward. You get paid directly, and you decide how to use the money. It's like having a financial ally who's got your back when you need it most. And as we all know, peace of mind is priceless.

Read also:Kirsten Too Sweet Nude The Untold Story Behind The Viral Sensation

What Are Aflac Benefits Exactly?

Alright, let's get down to business. Aflac benefits are supplemental insurance plans that provide cash benefits to policyholders when they experience specific health events. These events can range from hospital stays and surgeries to cancer diagnoses and even accidents. The beauty of Aflac is that it doesn't replace your primary health insurance; instead, it complements it by covering gaps that your main policy might leave behind.

Here's a quick rundown of what Aflac benefits typically cover:

- Hospital stays and overnight care

- Surgeries and medical procedures

- Cancer treatments and related expenses

- Accidents and injuries

- Maternity and newborn care

Think of Aflac benefits as your financial buffer. You can use the cash benefits to pay for deductibles, co-pays, transportation costs, or even everyday expenses like groceries and rent. It's all about giving you options when you need them most.

Why Do You Need Aflac Benefits?

Let's face it, life can be unpredictable. One moment you're cruising along smoothly, and the next, you're hit with a medical emergency that turns your world upside down. That's where Aflac benefits come into play. They're designed to help you navigate those tough times without breaking the bank.

Here's why you need Aflac benefits:

- They fill the gaps left by traditional health insurance

- They provide cash benefits that you can use however you see fit

- They offer protection for a wide range of health-related scenarios

- They give you peace of mind knowing you're prepared for the unexpected

And let's not forget the financial strain that unexpected medical issues can cause. According to a study by the American Journal of Public Health, medical bills are a leading cause of bankruptcy in the United States. Aflac benefits can help you avoid that nightmare scenario by providing a financial safety net when you need it most.

Read also:Unlocking The World Of Child Sotwe A Deep Dive Into An Emerging Trend

How Do Aflac Benefits Work?

Now that you know why Aflac benefits are essential, let's talk about how they work. When you purchase an Aflac policy, you choose the specific coverage that suits your needs. Once you're enrolled, Aflac pays you a predetermined amount of cash if you experience a covered event. It's that simple.

Here's a step-by-step breakdown:

- You experience a covered health event

- You file a claim with Aflac

- Aflac processes your claim and sends you a check

- You decide how to use the money

One of the coolest things about Aflac benefits is that the money goes directly to you, not your healthcare provider. This means you have the flexibility to use it for whatever expenses you're facing, whether it's medical bills, lost income, or even everyday living costs.

Types of Aflac Benefits

Aflac offers a variety of supplemental insurance plans to meet different needs. Here's a look at some of the most popular options:

Hospital Indemnity Insurance

This plan provides cash benefits if you're hospitalized due to an injury or illness. It can help cover costs like deductibles, co-pays, and other out-of-pocket expenses.

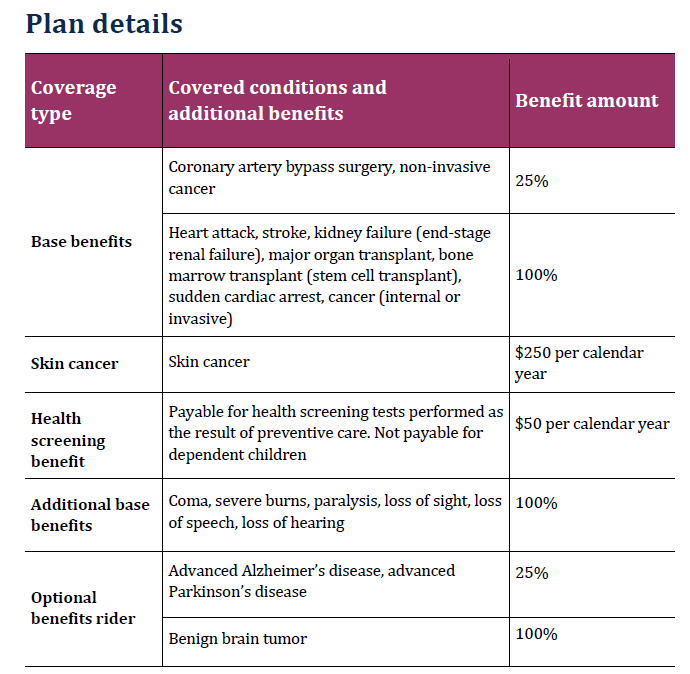

Critical Illness Insurance

If you're diagnosed with a serious illness like cancer, heart attack, or stroke, this plan pays you a lump sum of cash to help with treatment costs and other related expenses.

Accident Insurance

This plan offers financial protection in case of accidental injuries. It can help cover medical bills, lost wages, and other costs associated with accidents.

Cancer Insurance

Designed specifically for cancer-related expenses, this plan provides cash benefits to help with treatment costs, travel expenses, and other financial burdens.

With so many options available, you can tailor your Aflac benefits to fit your unique situation and needs.

Who Can Benefit from Aflac Benefits?

Aflac benefits are not just for one specific group of people. They're designed to help anyone who wants to protect themselves and their loved ones from the financial impact of unexpected health events. Here are a few examples of who can benefit from Aflac:

- Working professionals who want to safeguard their income

- Families looking for additional financial security

- Individuals with high-deductible health plans

- Retirees who want to maintain their financial stability

No matter your age, occupation, or financial situation, Aflac benefits can provide the peace of mind you need to face life's uncertainties.

How Much Do Aflac Benefits Cost?

One of the most common questions people have about Aflac benefits is how much they cost. The good news is that Aflac offers flexible pricing options to fit different budgets. The cost of your policy will depend on several factors, including the type of coverage you choose, your age, and your location.

Here's a rough estimate of what you can expect to pay:

- Hospital Indemnity Insurance: $20 - $50 per month

- Critical Illness Insurance: $30 - $70 per month

- Accident Insurance: $15 - $40 per month

- Cancer Insurance: $25 - $60 per month

Keep in mind that these are just estimates, and your actual cost may vary. It's always a good idea to get a personalized quote from Aflac to see what options are available to you.

How to Enroll in Aflac Benefits

Ready to sign up for Aflac benefits? The process is straightforward and can usually be done online or through a licensed agent. Here's what you need to do:

- Visit the Aflac website and select the coverage that suits your needs

- Provide some basic information about yourself and your health history

- Choose a payment plan that works for your budget

- Submit your application and wait for approval

Once you're enrolled, you'll have access to your Aflac benefits and the peace of mind that comes with knowing you're prepared for the unexpected.

Real-Life Examples of Aflac Benefits in Action

Let's look at a few real-life scenarios where Aflac benefits made a difference:

Case Study 1: John's Hospital Stay

John was involved in a car accident that left him hospitalized for two weeks. Thanks to his Aflac hospital indemnity insurance, he received a cash benefit that helped cover his medical bills and lost income during his recovery period.

Case Study 2: Sarah's Cancer Diagnosis

When Sarah was diagnosed with breast cancer, she was worried about how she would afford treatment. Her Aflac cancer insurance provided her with a lump sum of cash that she used to cover treatment costs and travel expenses to specialist appointments.

These stories are just a couple of examples of how Aflac benefits can make a real difference in people's lives.

Tips for Maximizing Your Aflac Benefits

Now that you're familiar with Aflac benefits, here are a few tips to help you get the most out of your policy:

- Understand your coverage and what's included in your plan

- File claims promptly to ensure timely payment

- Use the cash benefits wisely to cover necessary expenses

- Review your policy regularly to ensure it still meets your needs

By staying informed and proactive, you can make the most of your Aflac benefits and ensure they're working for you when you need them most.

Conclusion: Why Aflac Benefits Are a Must-Have

In conclusion, Aflac benefits offer a valuable layer of financial protection that can make all the difference when life throws you a curveball. Whether you're dealing with a hospital stay, a serious illness, or an unexpected accident, Aflac is there to help you cover the costs that your primary insurance might not touch.

So, what are you waiting for? Take the first step towards financial security by exploring Aflac benefits today. And don't forget to share this article with your friends and family who could benefit from the peace of mind that Aflac provides. Together, we can all be better prepared for whatever life throws our way.

Table of Contents:

- What Are Aflac Benefits Exactly?

- Why Do You Need Aflac Benefits?

- How Do Aflac Benefits Work?

- Types of Aflac Benefits

- Who Can Benefit from Aflac Benefits?

- How Much Do Aflac Benefits Cost?

- How to Enroll in Aflac Benefits

- Real-Life Examples of Aflac Benefits in Action

- Tips for Maximizing Your Aflac Benefits

- Conclusion: Why Aflac Benefits Are a Must-Have